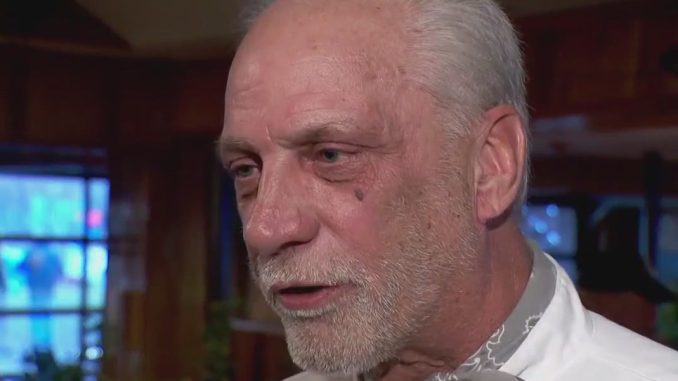

Jim Peterson, a well-known bar owner in Wisconsin, has filed for bankruptcy following an unexpected shift in leadership at his popular dive bar. The financial downfall comes just months after Peterson finalized a sale deal, which was intended to ensure the long-term success of the establishment. However, unforeseen management issues and financial missteps quickly led to instability, ultimately forcing Peterson into financial ruin.

Peterson had successfully operated the bar for over a decade, turning it into a staple of the local nightlife scene. His decision to sell the establishment was initially seen as a strategic move, aimed at securing his future while allowing new ownership to expand the business. However, the transition did not go as planned. The new leadership reportedly struggled to maintain customer loyalty, leading to a sharp decline in revenue. Operational costs soared, and mismanagement resulted in mounting debt.

Within weeks of the transition, reports surfaced that longtime patrons were dissatisfied with changes to the bar’s atmosphere, pricing, and service quality. Many customers stopped visiting, and the financial strain worsened. Sources close to the situation suggest that Peterson had maintained financial ties to the business even after the sale, which made him vulnerable when profits plummeted.

Despite efforts to salvage his financial standing, Peterson was left with no choice but to file for bankruptcy. Legal filings indicate that he is facing significant debts, including unpaid business loans and outstanding operational costs.

This unexpected downfall serves as a cautionary tale for small business owners navigating ownership transitions. While selling a successful business may seem like a lucrative exit strategy, unforeseen leadership challenges can quickly turn a promising deal into financial disaster.

Leave a Reply